Funds transfer pricing (FTP) is a process used by banks to measure how each source of funding (deposits and loans) contributes to the bank’s profitability. A bank’s business depends on the deposits it receives. It uses these deposits to make loans or investments. Interest payments made on these funds determine the bank’s overall net interest margin.

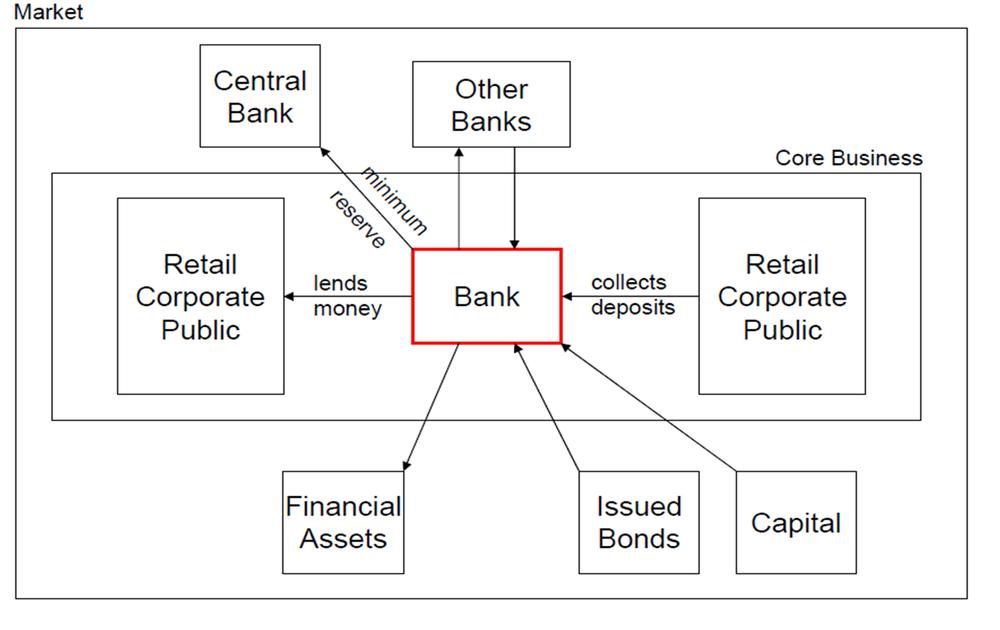

The net interest margin typically is the largest source of bank profits. Because funds transfer pricing helps to calculate the net interest margin on a bank’s funds, it is one of the most important tools for measuring the profitability of each of a bank’s funding sources. The Flow of funds:

The essence of transfer pricing is that each deal is seen as an isolated factor of success and assessed based on the principle of opportunity cost. This opportunity cost is the FTP (Funds Transfer Price) of the funds that are found in capital markets plus several additional opportunity cost factors.

The FTP as such is the riskless market rate, say a Treasury security, which is called the funds transfer rate (FTR), at matching maturities and conditions. By applying the concept of funds transfer pricing the contribution of each individual deal to the total net interest income is split into three main components:

contribution margin assets/liabilities/derivatives, bid/ask spread and transformation margin.

The latter comprises the maturity transformation margin and the currency transformation margin. Next I’ll take a look at the other components that make up the opportunity costs of a deal and eventually how we get to the client’s interest rate.